Five Point Holdings LLC (FPH)

just a nerd looking at debt indentures

This is not a stock pitch. It’s just me digging into some corporate fine print. I’m not going to tell you if Five Point Holdings is undervalued (or even what they do). You can figure that out for yourself!1 I’m only sharing some stuff that I think is interesting. Let’s start with a timeline of recent events.

July 24: FPH reports quarterly earnings. The market is disappointed and shares drop 15%. Note the following snippet from the conference call.

September 3: the CEO, CFO and COO receive large stock grants with aggressive hurdle rates. See the fine print below. Shares closed at $5.68 that day. These thresholds implied a 15% - 32% IRR over 5 years, with the stock having to quadruple for the highest threshold. These grants were off-cycle and in many ways atypical. More details about the grants here.

September 15: FPH announces a debt refinancing. They push out maturities to 2030 and will save about $20m in interest annually.

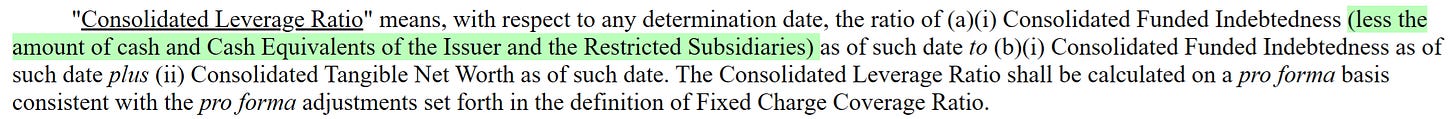

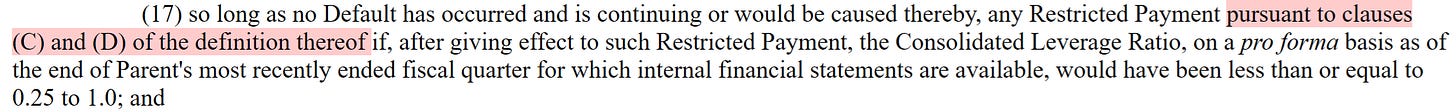

September 26: FPH files its new debt indentures with the SEC. Buried in the fine print are two key changes. First of all, the indentures now take into account cash when calculating the leverage ratio (FPH has a lot of cash on its balance sheet). Second, the old indentures only allowed ‘arbitrary’ cash payments pursuant to clause C (repay subordinated debt) and clause D (make some investments). Those restrictions have been removed. What are clause A and B payments that were forbidden beforehand? You guessed it: dividends and buybacks.

It is my belief that an atypical stock grant often has some signal value. In this case, two-thirds of Q3 had already passed when the board made the grant. It would be a bit of a backstab to grant officers equity with aggressive hurdle rates when you already know that the current quarter is going to be a disaster.

I think it is more likely that exactly the opposite happened. The board was aware about the upcoming debt refinancing and the potential for capital returns and made a ‘spring-load grant’,2 i.e. they made a timely grant of cheap equity when the stock dropped after disappointing Q2 results, just before the good stuff was shared with the public.

An open question for the reader: has all the good stuff been shared with the public? What do you reckon management is incentivized to do when 1) there’s a boatload of cash on the balance sheet and debt maturities are now half a decade away 2) debt indentures have been tuned to allow capital returns and 3) they need the stock price to quadruple to hit the jackpot?

An interesting paper about this phenomenon, which you could argue is a form of insider trading: https://jcl.law.uiowa.edu/sites/jcl.law.uiowa.edu/files/2021-08/SchipaniSeyhunAvciFinal_Web.pdf

Apologies for the lengthy comment. Now I'm not an expert on this stuff and I'm not questioning your research but I did want to share to ensure we get to the correct conclusion here. Interested to hear your thoughts.

Hi...love your posts...was doing my own due diligence on the new indenture issued and was trying to make sense of the document...it's not an easy read. I could not locate the excerpts you referenced relating to Consolidated

Leverage Ratio and dividends/repurchases. To simplify the read it occurred to me that this was a perfect use case for ChatGPT. Here is what it told me:

You said:

Please review following website: https://www.sec.gov/Archives/edgar/data/1574197/000119312525218100/d936070dex41.htm

ChatGPT said:

I reviewed the SEC document you linked: Exhibit 4.1 — Indenture, dated September 25, 2025 among Five Point Operating Company, LP, Five Point Capital Corp., the guarantors, and Computershare Trust Company, N.A. (as trustee) for 8.000% Senior Notes due 2030.

SEC

You said:

Is the issuer able to issue dividends to common equity shareholders

ChatGPT said:

No — under the Indenture in the document you gave, the issuer is not free to issue dividends (or make other “Restricted Payments”) to common equity holders except under tightly constrained circumstances.

Here’s how that works, based on Section 4.08 (Restricted Payments) of the Indenture:

What the Indenture says

“Restricted Payment” is explicitly defined to include declaring or paying dividends or distributions on the issuer’s (or its restricted subsidiaries’) equity interests, unless certain conditions are met.

The issuer and its restricted subsidiaries are forbidden to make Restricted Payments (including dividends) unless all the following are true:

No default or event of default is continuing, nor would one result from the payment.

After giving effect to the payment (on a pro forma basis), the issuer would still be able to incur at least US$1.00 of additional debt under certain incurrence restrictions.

The amount of the proposed Restricted Payment (plus all others since issuance, excluding certain permitted ones) must not exceed certain baskets or thresholds (e.g. 50% of cumulative net income, plus certain equity contributions) — the “Cumulative Buildup Basket.”

The Indenture also lists a number of exceptions / permitted types of “Restricted Payments” (i.e. actions that are not barred). These include, among others:

Dividends or distributions payable in equity (i.e. stock) rather than cash (excluding disqualified stock)

Within 60 days after declaration (if at the time of declaration the payment would have been permitted)

Restricted Payments up to a “basket” amount (whichever is greater of $75 million or 2.5% of consolidated tangible assets)

Other carve-outs laid out in Section 4.08(b)

Finally, the issuer’s public disclosures confirm that one of the constraints the Indenture imposes is on paying dividends or making other restricted payments on its equity stock.

SEC

Bottom line

So, yes — the issuer might be able to pay a dividend in certain limited scenarios, but only if all of the stringent conditions in Section 4.08 are satisfied, and subject to the exceptions. In practice, those limitations mean that dividends are heavily constrained and not freely available.

You said:

Is the issuer able to repurchase equity?

ChatGPT said:

Yes — but only under limited circumstances, and subject to the restrictions in the Indenture.

Here’s a breakdown of how the contract handles repurchases of equity (or “equity interests”) and when they are permitted:

What the Indenture says

From the Indenture (Section 4.08 “Restricted Payments”, as reflected in the Justia version) there are specific carve‑outs allowing certain equity repurchases, even though the general rule is to restrict them.

Some relevant excerpts / rules:

The general rule is that the issuer (and its restricted subsidiaries) cannot make “Restricted Payments,” which includes repurchases or redemptions of equity interests, unless all qualifying conditions are met.

However, several exceptions / permitted repurchases are spelled out. Some of them include:

Officer / employee plans: The issuer or subsidiaries may repurchase equity interests held by current, former, or future officers, directors, employees, or consultants (or their estates/heirs), under stock option or stock plans or similar agreements, subject to limits.

Withholding taxes: They may repurchase shares to satisfy tax withholding obligations (i.e. upon exercise of equity awards, to cover tax liabilities) via withholding of shares or payment in shares.

Exercise/Conversion: Repurchases deemed to occur upon the exercise, conversion or exchange of rights, if part of the purchase price, or to cover tax withholding, etc.

Annual limit: There is a cap on the aggregate amount of such permitted repurchases (or “other acquisitions”) in any calendar year (e.g., US$ 20 million), with carryover of unused amounts.

Thus, the issuer can repurchase equity, but only in narrow, pre‑authorized circumstances.

Conclusion

Can it freely repurchase equity across the board? No — the Indenture prohibits broad repurchases unless the issuer meets the specific conditions in the Restricted Payments covenant.

Can it repurchase in certain cases? Yes — for example, to satisfy tax withholding, via stock plans, or under employee/consultant equity agreements, subject to annual caps and other constraints.