Galaxy Gaming (OTC:GLXZ)

nice either way?

Introduction

Galaxy Gaming has been a FinTwit and VIC darling for years.1 A brief history: some geniuses had the insight that it would be fun in Blackjack to have the option to earn extra money if you win with a pair of queens. They called this side bet ‘Lucky Ladies’ and patented and trademarked the hell out of it. The house edge of this bet is approximately 25%, meaning that you piss away, on average, 25 dollars every time you wager 100 dollars. You might say: that’s stupid. You’d be wrong. Galaxy Gaming turned this extortionary concept into a successful licensing business model.

Unfortunately, while revenue was growing at a nice clip, Galaxy was forced to borrow too much money. Rates went up, interest payments ballooned, shareholders got frustrated. After a few years of disappointment Evolution AB decided to scoop up Galaxy Gaming last summer for $3.20 per share, a 100%+ premium over the undisturbed price.

The merger was expected to close in mid-2025. We now live in mid-2025 but Galaxy Gaming is trading around $2.80. Clearly something is off here. I think the market is concerned about the antitrust risk of the largest live online gambling provider buying IP that could hamstring their smaller competitors.2 How should investors deal with that risk? My solution is simple: I’m ignoring it.

Financials

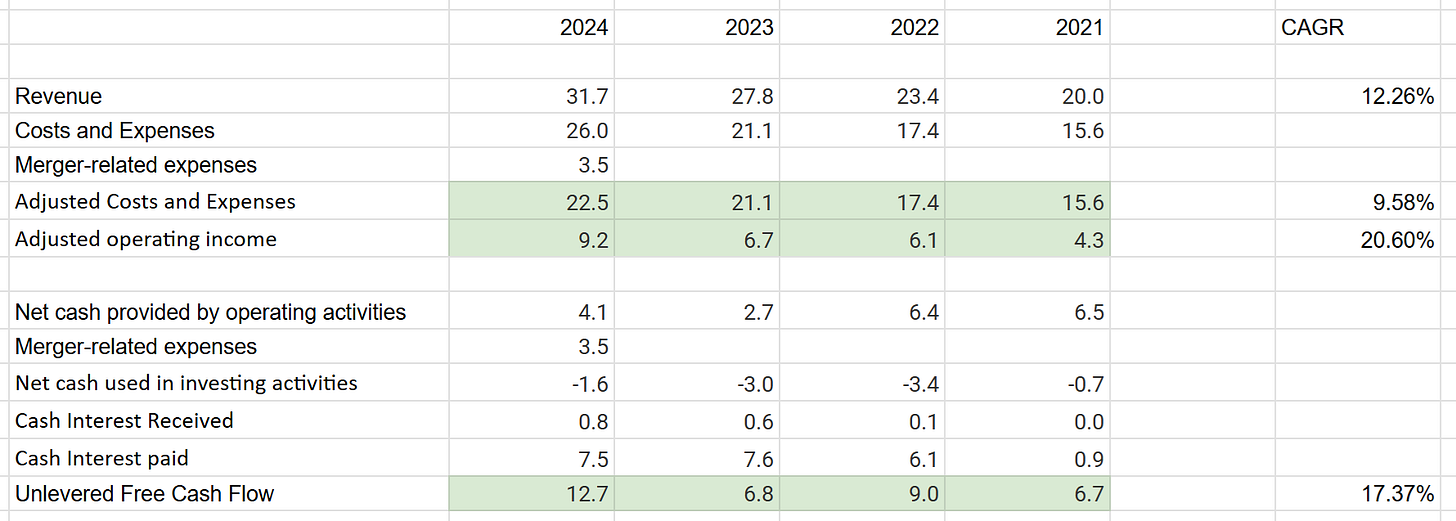

Why? Let’s have a look at Galaxy. The company makes money licensing their IP to both physical and virtual casinos. Revenue grew 12% p.a. over the past decade, 8% over the past five years. Gross margins are close to 100%. Cash conversion is excellent.3 What should be obvious is the operating leverage of the licensing business model. As long as Galaxy can keep costs in check incremental revenue has a big impact on the bottom line.

Earlier this year I thought an important piece of news was released: Galaxy refinanced its debt. As of Q1 2025 they pay SOFR + 3.5% (about 8%) on a reduced debt balance of $45m. This will save the company $3m+ per year in interest payments. Galaxy can finally start paying off meaningful amounts of principal.

What would Galaxy look like in a few years? I could (and probably should) make a big model in a spreadsheet, but, fortunately for me, management shared their business outlook in the merger proxy. Note that this outlook is already a bit outdated because 2024 was a better year than projected.4

The extended outside date for the merger is January 18, 2026. Let’s assume the deal falls apart at that point due to regulatory intervention. If so, Evolution is required to pay a $5m ‘parent termination' fee’ to Galaxy. On top of that, I reckon Galaxy should be able to pay down at least ~$5m in debt in 2025 by itself. This brings the net debt position down to ~$35m5, leading to a $105m enterprise value at the current market capitalization. Management guidance for 2026 implies that equals a ~6x forward EV/EBITDA multiple or a ~7x forward EV/EBIT multiple. That seems cheap to me for a company that:

has close to 100% gross margins.

has excellent cash conversion and requires little capex.

has grown revenue 12% p.a. the past decade.

has 18% insider ownership.

projects EBIT and cashflow to roughly double in 5 years.

has enough (history with) leverage to make capital allocation obvious.

Note that early in 2024, before the merger was announced, Galaxy was trading at an enterprise value of ~$70m with 2024 guidance of $12.5m in adjusted EBITDA, a 6x multiple. In other words, the current price already implies a pre-deal multiple if the deal falls apart, even though Galaxy is in much better shape now due to the debt refinancing.

Conclusion

I think Galaxy is potentially in a limbo. Fundamental investors don’t care too much about 15% upside in a risky merger arb and are hoping the deal falls apart so they can feast on the carcass. And special situation investors don’t like the regulatory risk and the huge premium offered to the undisturbed stock price.

Usually when I evaluate a merger I try to determine a weighted IRR of all outcomes. I’m not doing that here. My point is this: I am a happy owner of Galaxy Gaming at $2.80. The market seems to imply that Galaxy will drop like a brick if the merger falls apart but I’m skeptical about that. Is it really going to trade at 4x forward EV/EBIT? If so, I’m probably buying more and I won’t even feel bad about it. I think Galaxy is finally in a good spot where the debt situation is under control, the company is GAAP profitable and modest growth will have a big impact on the bottom line. It looks very cheap a few years down the line if you extrapolate past results. I don’t really care for the merger either way.

Is this an ‘excellent idea’? Nah. Is this a big position for me? No, it isn’t.6 But it is good enough for me to dip my toes in the water. Maybe the better play is to wait for the merger to break down and hope that the stock crashes. Up to you. Let me know what you think.

Imagine: it’s Sunday afternoon, you lie on your couch, had a few beers, turn on your laptop to look for that beautiful Moldovan Blackjack dealer (you really have a connection with her) to get back to break-even after the horrible session yesterday. You are about to make your first bet and then you realize: “Hey, these guys don’t offer the Lucky Ladies side bet anymore!”. Really ruins the fun experience.

Note that I ignore taxes as the company is not paying cash taxes at the moment. That will change in the future. Also note that unlevered FCF exceeds operating income due to ~$5m in stock-based compensation (should not be ignored), a ~$2m release of working capital and D&A being $2m higher than capital expenditure.

The outlook also assumes a big slowdown in revenue growth and cash taxes being paid in every year. If anything, I think management is incentivized to lowball their projections a bit, to avoid setting themselves up for lawsuits.

I’m assuming they need the current $5m on the balance sheet for working capital purposes.

I rarely have big positions because I rarely have great ideas. Unlike the compounder bros I manage my portfolio like a thrift store. A lot of trash comes in and out every year and I hope to have a little edge on every transaction. No bold bets, no genius insights. If it turns out I’m an idiot my returns will simply approach those of the market. The good thing is that my returns have been satisfactory so far and that I will never go broke or lose any sleep over my portfolio.

Comment from the EVO call today: "We're also progressing well with the Galaxy acquisition, and we expect to close the transaction during the second half of 2025".

From an IRR perspective it is probably desirable that the deal closes. But secretly I'm kind of curious where it is going to trade in case of a deal break. Would be less profitable (at least in the short run) but more interesting!

Well, closing guidance is 2nd half 2025 now, possibly due to multiple ongoing country/state/tribal reviews. EVO appears to have had some regulatory trouble recently, and there were even some objections raised by unions related to a massive labour dispute in Georgia (the country).

Meanwhile, 1Q'25 revenue declined again, EBITDA was flat, so tough to say where the downside could be.